The connection to Jeffrey Epstein is just one of many questionable relationships

Recently, two scholars announced their plans to cut ties with the MIT Media Lab over its longstanding relationship with Jeffrey Epstein—the New York financier who had been arrested on federal charges for the alleged sex trafficking of minors in Florida and New York and committed (a suspiciously convenient) suicide in custody on Aug 10. Ethan Zuckerman, director of the Center for Civic Media at MIT (which is “a collaboration between the MIT Media Lab and Comparative Media Studies at MIT,” according to its website) and an associate professor of the practice at the MIT Media Lab, and J. Nathan Matias, a Cornell University professor and visiting scholar at the lab, are certainly to be commended for having the courage of their convictions. Particularly Zuckerman, who is literally leaving his job over the Epstein affair.

The lab’s direct connection to such a highly placed, dangerous, previously convicted sex offender is certainly more than enough reason for staffers, affiliates, and grad students to consider resigning their posts. However, it must be said to those who stay on that there have always been plenty of other reasons to resign from the MIT Media Lab from the moment it opened its doors. Because “capitalism’s advanced R&D lab”—as a colleague of mine close to the current fray calls it—has never been picky about which donors it will accept funding from. And that presents a major dilemma for other people of good conscience who happen to be working there.

So, I decided it would be worth a quick spin through some of the misdeeds of a few of the most well-known Media Lab corporate donors. In hopes that other people connected to the highly problematic institution might also decide to announce an abrupt career change in the name of social justice. Better still, they could organize themselves into a movement to either reform where the lab gets its money—and on whose behalf it works—or simply break it up. And maybe spread its projects around to other, less compromised, institutions.

BP and ExxonMobil. Every energy company engaged in extracting oil, natural gas, and coal, processing it, and/or distributing it to be burned in internal combustion engines or power plants is hastening the extinction of the human race by inducing ever-worsening global warming. With knowledge aforethought. As evinced by the organized campaign of disinformation they have all led against climate science, according to the noted book and documentary Merchants of Doubt by Naomi Oreskes of Harvard University and Erik M. Conway of NASA’s Jet Propulsion Laboratory at the California Institute of Technology. There is no way to take this money and still have clean hands. Whether it’s a thousand dollars or a million. MIT Media Lab leadership knows this and does it anyway.

Ford Motor Company. A company as old and as large as Ford has inevitably done a lot of reprehensible things. Two of the worst: a) producing carbon-burning, greenhouse gas-emitting vehicles for over a century (almost 400 million since 1903) and b) working with energy companies like the ones that became ExxonMobil to form the Global Climate Coalition—a key international lobby group that spearheaded the fight by major corporations against climate science to prevent environmental regulation that would negatively affect their bottom line, according to Oreskes and Conway. It is the fifth-largest vehicle manufacturing company in the world.

Hyundai Motor Company. The third-largest vehicle manufacturing company in the world. And therefore another corporate scofflaw even without looking at its miserable record of union busting. Continuing to flood the planet with millions more carbon-spewing, global warming exacerbating machines every year. Oh, and the Korean conglomerate also got caught “overstating” its vehicles’ mileage a few years back, according to US News and World Report.

Honeywell SPS. While the Safety and Productivity Solutions “strategic business unit” of Honeywell International Inc. is the one giving money to the MIT Media Lab, its parent corporation is a major defense contractor. And a particularly dangerous strain of that breed of sociopathic capitalist entity. According to the Don’t Bank on the Bomb website produced by the interfaith Dutch antiwar group PAX, “Honeywell is involved in US nuclear weapon facilities as well as producing key components for the US Minuteman III ICBM and the Trident II (D5) system, currently in use by the US and UK.” Because what could possibly go wrong with continuing to produce more nukes?

Citigroup. One of the main American banks responsible for the 2008 global financial collapse thanks to heavy investment in derivatives based on subprime housing mortgages. Also, the recipient of one of the largest bailout packages from the federal government in US history. That was either as “little” as $45 billion in Troubled Asset Relief Program (TARP) money (which it paid back), or as much as $500 billion—when all government assistance it received is included (much of which it didn’t have to pay back)… according to a Wall Street Journal op-ed by James Freeman, co-author of the critical Citigroup history Borrowed Time. Most of the tens of thousands of working families whose lives were ruined when their homes were seized for mortgage nonpayment by the banks which set them up to fail did not get a bailout.

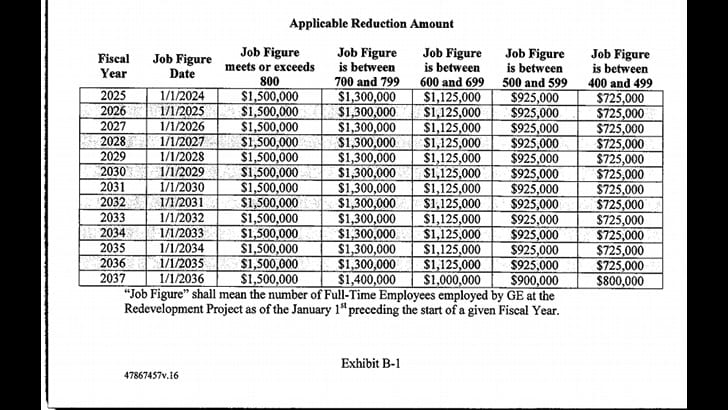

GE. A company I have written a baker’s dozen pieces on, between the start of the GE Boston Deal in 2016 and this year (when said deal fell apart). Once a major employer in Massachusetts, GE not only destroyed the economies of several cities around the state by precipitously shutting down major plants—in part to cut costs by eliminating thousands of good unionized jobs—but also polluted the entire Housatonic River valley from northwest Mass to Long Island Sound, as I covered in parts one and seven of my GE Boston Deal: The Missing Manual series. Yet is still trying to avoid having to finish cleaning that toxic mess up. Furthermore, GE was heavily involved in causing the 2008 global financial collapse through its former “shadow bank” division GE Capital and was the recipient of a huge government bailout via $90 billion in cheap credit it definitely did not deserve, as I outlined in parts two and three of my series.

McKinsey & Company. A virtually unaccountable private consulting firm with its fingers in many multinational corporate pies—and a special emphasis on working with authoritarian governments. The New York Times has spent years exposing some of its more sordid activities, including running the $12.3 billion offshore hedge fund MIO Partners, identifying the social media accounts of three prominent online critics of the Saudi government (one of whom was subsequently arrested), and helping Boeing find some needed titanium by getting a Ukrainian oligarch to bribe eight Indian officials. Plus, it reported—close to home and perhaps worst of all—that the “[Commonwealth] of Massachusetts released new documents from 2013 that detailed McKinsey’s recommendations on how Purdue Pharma could ‘turbocharge’ sales of its widely abused opioid OxyContin. The state said McKinsey advised Purdue to sharply increase sales visits to targeted doctors and to consider mail orders as a way to bypass pharmacies that had been tightening oversight of opioid prescriptions.” The thousands of opiate deaths in the Bay State alone since that time are on the criminal consultancy’s head—along with Purdue, and other corrupt pharmaceutical companies.

GlaxoSmithKline, F. Hoffmann-La Roche AG (Roche), Novartis, and Takeda. And speaking of pharmas, here are four that donate to the Media Lab. All of which make huge profits by converting largely publicly funded basic science research into privately owned drug formulas protected by patents and other exclusive rights granted to them by governments. Then repurposing older medications for different uses—for which they receive new patents. According to a Washington Post op-ed by Robin Feldman, the author of Drugs, Money, & Secret Handshakes, “…78 percent of the drugs associated with new patents were not new drugs coming on the market but existing ones. The cycle of innovation, reward, then competition is being distorted into a system of innovation, reward, then more reward.” Ultimately, big pharmas extend their monopolies over the most profitable drugs by using their dominant positions to keep cheaper generic versions produced by smaller pharmas from gaining a foothold for years after they’re finally allowed to enter the market. The amount of unnecessary misery created by such companies in countries like the US that lack a comprehensive national healthcare system able to keep drug prices low is, therefore, immense. On top of the more specific misery caused when Takeda’s diabetes drug Actos was found to cause bladder cancer, according to the New York Times. Or when Roche made serious bank by convincing government to stockpile the influenza drug Tamiflu and was later found to have been withholding vital clinical trial data showing it wasn’t very effective, according to the Guardian. Or when GlaxoSmithKline “agreed to plead guilty to criminal charges and pay $3 billion in fines for promoting its best-selling antidepressants for unapproved uses and failing to report safety data about a top diabetes drug,” according to the New York Times. Or the ongoing scandal resulting from the FDA accusing Novartis of manipulating the “data used to support approval of the drug Zolgensma,” according to Stat. Which is supposed to be a treatment for the rare baby-killing genetic disorder spinal muscular atrophy and is the most expensive drug in the world at $2.1 million for a one-dose treatment, according to NPR.

Deloitte. Just a bunch of harmless accountants, right? Wrong. According to Canada’s National Observer, Deloitte is the largest of the “Big Four” audit firms that have “emerged as central players in the creation and abuse of offshore tax havens.” They also “become champions of the privatization of government services.” Giving a hearty assist to the consolidation of wealth by ever smaller numbers of corporations and individuals. Thus diminishing the governments that were once able to tax the rich and powerful and use the money to provide the very public services that have gradually been privatized—and concentrating more of the remaining public funds in those same private hands.

That’s just a sample of the dozens of MIT Media Lab “member companies.” Not all of them are as bad as the ones above. But few are above reproach. Check them out yourself at media.mit.edu/posts/member-companies/. And consider what kind of university would allow one of its major initiatives to run for decades with such little regard for social responsibility.

Full disclosure: Jason Pramas has interacted with Ethan Zuckerman professionally from time to time.

Apparent Horizon—recipient of 2018 and 2019 Association of Alternative Newsmedia Political Column Awards—is syndicated by the Boston Institute for Nonprofit Journalism. Jason Pramas is BINJ’s executive director, and executive editor and associate publisher of DigBoston. Copyright 2019 Jason Pramas. Licensed for use by the Boston Institute for Nonprofit Journalism and media outlets in its network.